Global Fruits and Vegetables Trade Overview: July and August 2024

The global fruits and vegetables trade has been marked by significant developments in recent months, driven by fluctuating market demands, environmental challenges, and geopolitical shifts. This report provides an in-depth analysis of the trade dynamics from July and August 2024, highlighting key statistics and trends across major exporting and importing regions.

1. U.S. Fresh Produce Exports

During July and August 2024, the United States maintained its position as a leading exporter of fresh produce. Export volumes for these two months totaled approximately 2.3 million metric tons, generating $4.2 billion in revenue. Canada remained the largest importer, absorbing over 40% of U.S. fresh produce exports, followed by Mexico and Japan. Despite facing rising transportation costs and competition from emerging markets, U.S. exports to Asia, particularly China and South Korea, grew by 3.5% year-over-year, driven by the strong demand for high-quality apples and citrus fruits.

2. European Market Developments

The European fruit and vegetable market experienced notable challenges over the summer of 2024. Adverse weather conditions, including unseasonal rains and droughts, significantly impacted production and export volumes:

- Apple Exports: Europe, especially Poland and Italy, witnessed a 3.7% decline in apple exports during this period. Poland’s apple production is forecasted to decrease by 2.3% for the year, affecting its ability to meet demand in key markets such as Russia and Eastern Europe.

- Tomato Market: European tomato exports dropped by 2% in July and August 2024 compared to the same period last year. This reduction is attributed to prolonged droughts in Southern Europe, which have reduced yields. To compensate, importing countries like the UK and Germany have increasingly turned to alternative suppliers, including Morocco and Turkey.

3. Latin American Bananas

Latin America’s banana industry continues to play a critical role in global trade:

- Ecuador: As the world’s largest banana exporter, Ecuador saw a 3.8% increase in banana exports in July and August 2024, with a total volume of approximately 700,000 metric tons. This growth is fueled by increased demand from China following the enactment of favorable trade policies. However, European markets are exerting downward pressure on prices, as retailers negotiate lower costs due to an influx of bananas from alternative sources.

- Colombia: Colombia maintained stable export volumes during these months, though concerns over Fusarium wilt, a plant disease affecting bananas, have led to intensified monitoring and preventive measures. This may influence future yields and export capacities.

4. Southeast Asian Market Insights

Southeast Asia remains a vibrant region for fruit exports, with countries like Thailand and Vietnam leading the way:

- Thailand: Thailand’s durian exports reached 750,000 metric tons in July and August 2024, marking a 5% increase from the previous year. The nation’s enhanced rail infrastructure has improved export efficiency, particularly to China, the largest market for Thai durians. Despite some fluctuations in supply, prices have remained stable.

- Vietnam: Vietnam’s fruit and vegetable exports surged by 6.5% year-over-year during these months, largely driven by strong demand for tropical fruits such as dragon fruit and lychee. China remains Vietnam’s top export destination, accounting for over 70% of its total fruit exports.

5. Asia-Pacific Region

- India: In July 2024, India lifted its export ban on onions, causing domestic prices to plummet by 40%. This move resulted in a temporary surge in exports to Southeast Asia and the Middle East, but the ban was reintroduced in August due to rising domestic inflation, leading to significant disruptions in these markets.

- China: China continues to dominate the global apple market, with production expected to increase by 1.2% in 2024, reaching 43.5 million metric tons. In July and August, China’s apple exports grew by 24%, driven by robust demand from Japan and South Korea despite challenges such as increased shipping costs.

6. Egyptian Fruit and Vegetable Industry

Egypt remains a pivotal player in the global fruits and vegetables trade, with its exports primarily comprising citrus fruits, onions, and garlic. The country’s strategic location and favorable climate make it an ideal supplier for European, Middle Eastern, and Asian markets:

- Citrus Fruits: Egypt is the world’s largest exporter of oranges, with a forecasted export volume of 1.6 million metric tons for 2024. The country’s citrus exports have seen a steady increase in demand from European and Asian markets due to their high quality and competitive pricing.

- Onions and Garlic: In July and August 2024, Egypt’s exports of onions and garlic surged by 5%, driven by heightened demand in Europe and the Gulf Cooperation Council (GCC) countries. These products are valued for their quality, long shelf life, and consistency in supply.

7. Gezira United: A Leader in Egyptian Agriculture

Gezira United is at the forefront of Egypt’s agricultural export industry, renowned for its innovative farming practices and commitment to sustainability. As one of the pioneers of drip irrigation in Egypt’s banana plantations, Gezira United has significantly increased its yield while minimizing water usage. This method not only conserves vital water resources but also enhances the quality of the produce.

Gezira United’s sub-brand, Banana Island, specializes in exporting premium Egyptian bananas to markets across Europe and the Middle East. With a strong focus on quality control and adherence to international standards, Banana Island has established itself as a trusted supplier for high-demand markets. The company’s commitment to sustainable farming practices and efficient supply chain management ensures that customers receive fresh, high-quality bananas that meet their expectations.

For more information on Gezira United and its products, visit Gezira United.

Conclusion

The global fruits and vegetables trade is a dynamic and complex sector, with various factors influencing market trends. As demonstrated in July and August 2024, challenges such as weather disruptions, geopolitical tensions, and evolving consumer preferences continue to shape the industry. However, with strong players like Gezira United leading the way in sustainable agriculture and efficient export practices, the future of global produce trade remains promising.

References

- USDA Foreign Agricultural Service: Fruits and Vegetables Data and Analysis

- Fruit Growers Tasmania: Global Trade Report 2024

Explore

-

Fruit Logistica 2024 with the IPD

-

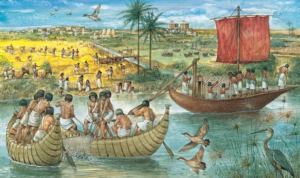

From Pharaohs to Ports: Egypt's Produce Export Journey

-

Egyptian Red Onion: Now Available with the Best Price!

-

A Guide to Egyptian fruit and Vegetable Exporters and Growers

-

Why You Should Import Egyptian Fruits and Vegetables

-

Egyptian garlic: Reasons behind importers' growing preference for it

-

Unveiling the Superiority of Egyptian Onions in the Global Export Market

-

Drip Irrigation: Nurturing Crops, Preserving Resources

-

VIDEO: 2024 Fruit Logistica Summed Up - Valuable Insights

-

The Lifecycle of an Onion: From Seed to Export